What is Values-Based Investing?

At its core, values-based investing seeks to align your financial goals with your personal beliefs. We seek to offer a straightforward approach for your investments to reflect what matters most to you. Every investor has a mission, and that mission matters.

Values-based investing also includes considering non-financial factors that may resonate with investors’ core convictions—such as product involvement or business ethics. The goal is to identify securities good for the world.

With values-based investing, your portfolio can match your mission. Part of Crossmark’s mission is to inspire and equip our clients to go further in all God has for them. With an objective and quantitative approach, our values-based methodology identifies investments that first and foremost seek to meet your financial goals, while also prioritizing your values.

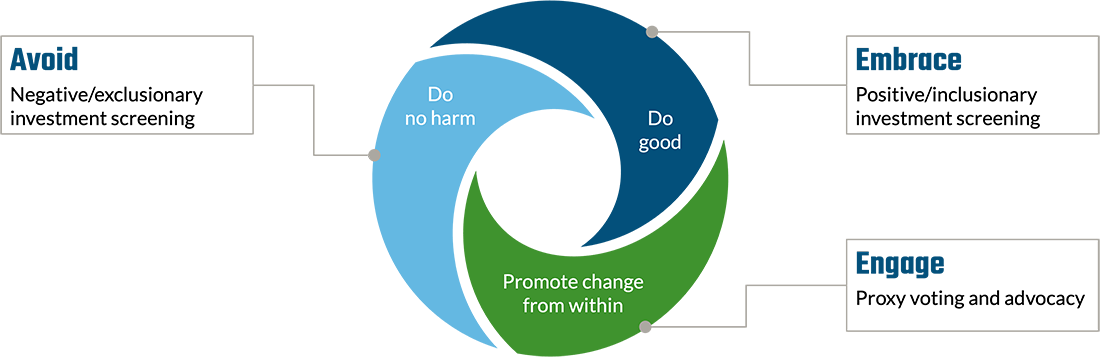

Aligning investments with values

Each client has a different set of priorities and values that affect how they want to invest. We help investors align their values with a broad spectrum of investment solutions that align with these themes.

Avoid

Do no harm

“Avoid” or “negative screening” is the process of excluding investments in companies or sectors that fail to meet certain nonfinancial (risk-based) standards, such as controversial industries or poor corporate governance. Some of these standards may be based on a company’s product or service and measured on materiality and/or direct involvement. Examples may include alcohol, gambling, tobacco, and pornography. These exclusions are designed to minimize exposure to various risks, whether regulatory, economic, sustainability-related, or otherwise.

Embrace

Do good

Values-based investors are committed to doing good by choosing to support companies that embrace ethical business practices. Positive inclusion enables us to actively seek out those companies that, through their internal and external activities, work to reduce risk and build long-term resilience using sustainable and responsible business practices. At Crossmark, we intentionally seek to include these kinds of companies in our portfolios when the “embrace” screen is applied.

Responsible governance practices

Fair treatment of employees

Positive engagement with the communities in which they operate

Sustainable business practices

Engage

Promote change from within

Corporate engagement is the practice of investors using their ownership stake in a company to influence corporate behavior. Examples of engagement include proxy voting and direct engagement through dialogue with company management. Corporate engagement may focus on areas such as corporate governance, ethics, sustainability, or business practices to achieve investors’ desired shareholder and/or stakeholder outcomes. We amplify our voice by joining advocacy efforts with like-minded membership organizations.

Our values-based philosophy

The foundation of our methodology lies in our values-based screening capability, built on this cornerstone: time-tested investment strategies grounded in rigorous quantitative research and analysis. By incorporating values-based criteria into our investment process, we strive to develop a complete picture and identify risks that may go unnoticed when relying solely on traditional financial metrics and fundamental analysis. We use the acronym VALUES to describe our philosophy.

Our analysis and screening is open and transparent, and our results are substantiated by evidence-based data.

Our experienced team has a deep understanding of screening issues and is able to apply this knowledge within the screening framework across a broad set of securities as defined by the primary benchmark for each investment strategy.

Our methodology is disciplined and diligent using well-defined criteria and systematic measurements.

Data is sourced from one or more independent, third-party providers.

Our approach is quantitative in nature, and our decisions are grounded in evidence-based data, not based on personal opinions or popular trends.

The outcomes of our screening methodology are repeatable, and our process can be maintained and replicated over multiple time periods.